Sales Tax By State Map

Sales tax by state map

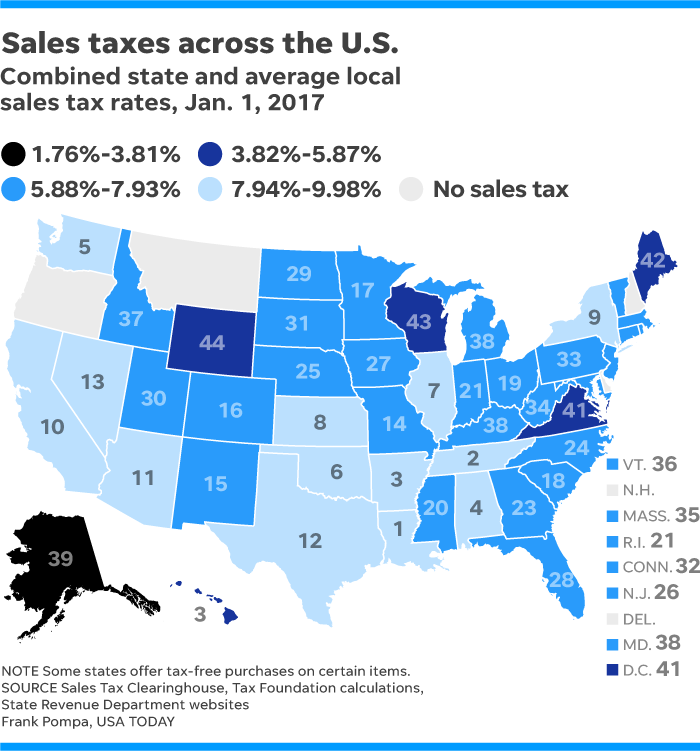

Use the color key below to identify which system each state uses. Excise and consumption taxes.

State Sales Tax Which States Are Most Affected By The Supreme Court Online Retail Ruling Tax Rate Tax Free States Income Tax

State Sales Tax Which States Are Most Affected By The Supreme Court Online Retail Ruling Tax Rate Tax Free States Income Tax

Sales taxes are generally collected on all sales of tangible goods and sometimes services completed within the state although several states have started moving toward levying sales taxes on residents who make purchases online as well.

Use both tax liens and tax deeds. Map of local sales tax rates in the united states sales taxes in the united states are administered on a state level in all but the five states with no state sales tax as well as locally by counties and cities in the 37 states that allow municipal governments to collect their own local option sales taxes. State sales tax map. Capital gains and dividends taxes.

Estate and gift taxes. Click on any county for detailed sales tax rates or see a full list of washington counties here. Still everyone is subject to federal income taxes regardless of where you live. Tax sale state map state info.

Hover over or click on any state in the map for the option to add the. Small business pass throughs and non. Click a state name to get helpful sales tax info. Tax compliance and complexity.

Income and payroll taxes. Tax sale state breakdown chart listed below is a chart with all 50 states and the tax sale type auction dates interest rate returns and. How much you pay depends on how much you. Individual and consumption taxes.

This interactive sales tax map map of washington shows how local sales tax rates vary across washington s 39 counties. This table and the map above display the base statewide sales tax for each of the fifty states. Tax expenditures credits and deductions. Washington has state sales tax of 6 5 and allows local governments to collect a local option sales tax of up to 4.

Explore our weekly state tax maps to see how your state ranks on tax rates collections and more. Compare state tax rates and rules on income ordinary purchases gas sin products property and more across the u s. State laws determine how property taxes are issued and enforced. There are 3 different enforcement systems identified in state laws.

The state has one of the highest sales tax rates in the country at 7.

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

State And Local Sales Tax Rates 2013 Tax Rate Income Tax Payroll Taxes

State And Local Sales Tax Rates 2013 Tax Rate Income Tax Payroll Taxes

Post a Comment for "Sales Tax By State Map"